Alan Waxman Net Worth: Investment Guru’s Financial Insights

Alan Waxman net worth serves as a testament to his expertise in investment management, characterized by a meticulous approach and an ability to navigate fluctuating market conditions. His strategic focus on diverse asset classes, including real estate and technology, underscores a forward-thinking philosophy that many aspiring investors seek to emulate. As we explore the nuances of his financial strategies and the impact they have had on the investment landscape, it becomes clear that understanding Waxman’s principles may be key to unlocking one’s own financial potential. What specific lessons can we extract from his journey?

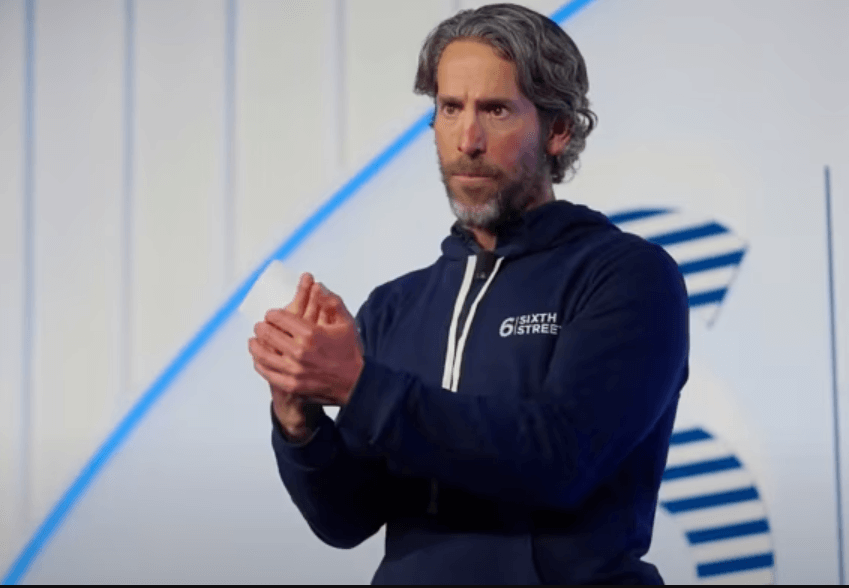

Alan Waxman’s Background

Alan Waxman, a prominent figure in the financial industry, has built a career characterized by strategic acumen and extensive expertise.

His early career was marked by pivotal roles that honed his analytical skills.

With a robust educational background, including advanced degrees in finance, Waxman laid a strong foundation for his future endeavors, enabling him to navigate complex market landscapes with confidence and insight.

Overview of His Investment Philosophy

Building on his solid foundation in finance, Waxman’s investment philosophy emphasizes a disciplined approach to portfolio management and risk assessment.

Central to his investment principles is the belief that understanding market dynamics is crucial for success.

Key Strategies for Success

Successful investment strategies often hinge on a combination of rigorous analysis and adaptive decision-making.

To achieve success, consider these key strategies:

- Conduct thorough market analysis to identify trends.

- Implement effective risk management practices to safeguard investments.

- Diversify portfolios to mitigate exposure.

- Regularly reassess strategies to adapt to changing market conditions.

These principles empower investors to navigate complexities with confidence and agility.

Breakdown of Net Worth

Understanding Alan Waxman’s net worth requires a detailed examination of his asset allocation strategy, which reveals how he balances risk and growth.

Additionally, the composition of his investment portfolio illustrates the diversity of his financial interests, while an overview of his income sources provides insight into the various revenue streams contributing to his wealth.

Together, these factors paint a comprehensive picture of Waxman’s financial standing.

Asset Allocation Strategy

While various factors influence an individual’s financial standing, a well-defined asset allocation strategy is crucial for optimizing net worth.

Key components to consider include:

- Risk Tolerance – Assess personal comfort with market volatility.

- Diversification Benefits – Spread investments across asset classes to mitigate risk.

- Time Horizon – Align investments with financial goals.

- Rebalancing Frequency – Regularly adjust allocations to maintain desired risk levels.

Investment Portfolio Composition

Analyzing the investment portfolio composition is essential for grasping the intricacies of net worth.

Alan Waxman employs robust portfolio diversification strategies to mitigate risk and enhance returns. His investment choices reflect a balanced approach, integrating equities, fixed income, and alternative assets.

Additionally, he applies effective risk management techniques, ensuring that his portfolio withstands market volatility while capitalizing on growth opportunities for sustained wealth accumulation.

Income Sources Overview

The composition of Alan Waxman’s income sources plays a significant role in shaping his overall net worth.

His diversified income strategy includes:

- Equity investments generating capital gains.

- Real estate ventures providing rental income.

- Advisory fees from consulting services.

- Passive earnings from dividends and interest.

This multifaceted approach not only enhances financial security but also aligns with his philosophy of achieving freedom through wealth.

Read more: Streak-Free Window Cleaning Services for a Clear View

Notable Investments and Ventures

Alan Waxman has made significant strides in both strategic real estate holdings and innovative tech startups, reflecting his diverse investment portfolio.

His approach to real estate emphasizes long-term value and market trends, while his interest in technology focuses on emerging companies poised for disruption.

These ventures not only enhance his net worth but also underscore his adaptability in varying market landscapes.

Strategic Real Estate Holdings

Strategic real estate holdings have become a cornerstone of wealth accumulation for investors like Alan Waxman, underscoring the importance of identifying lucrative opportunities in the property market.

Key factors include:

- Real estate diversification to mitigate risks.

- Market timing to maximize returns.

- Location analysis for future growth.

- Understanding market trends to anticipate shifts.

These strategies enhance long-term profitability and financial freedom.

Innovative Tech Startups

How can innovative tech startups drive significant returns for investors like Alan Waxman?

By harnessing blockchain innovations and tapping into vibrant startup ecosystems, these ventures present unparalleled opportunities. Investments in companies leveraging decentralized technology not only promise transformative solutions but also create pathways for substantial financial gains.

Waxman’s strategic selections in this domain reflect a keen understanding of emerging trends and their potential impact on market dynamics.

Impact on the Investment Community

Influencing the investment community, Alan Waxman has established himself as a pivotal figure through innovative strategies and insightful market analysis.

His impact can be seen in:

- Enhanced financial literacy among investors.

- Promotion of ethical investment practices.

- Encouragement of diverse portfolio strategies.

- Development of accessible investment resources.

These contributions empower individuals, fostering a culture of informed decision-making within the financial landscape.

Lessons for Aspiring Investors

Alan Waxman’s influence on the investment community extends beyond immediate market strategies; it also offers valuable lessons for aspiring investors.

Emphasizing an investment mindset, he advocates for thorough market research, robust risk assessment, and portfolio diversification.

Financial discipline, emotional intelligence, and strategic planning are crucial, while mentorship value and networking opportunities enhance growth, ultimately fostering a long-term vision for sustainable investment success.

Market Trends and Predictions

Market trends and predictions serve as critical indicators for investors aiming to navigate the complexities of the financial landscape.

Key factors influencing market volatility include:

- Economic indicators like GDP growth and unemployment rates

- Central bank policies and interest rate changes

- Global geopolitical tensions impacting trade

- Technological advancements reshaping industries

Understanding these elements can empower investors to make informed decisions amidst uncertainty.

Final Thoughts on Wealth Management

Effective wealth management embodies the principles of strategic planning and informed decision-making. Achieving wealth preservation requires enhanced financial literacy, empowering individuals to navigate investments wisely. Below is a concise framework illustrating key components of wealth management.

| Component | Importance | Strategy |

|---|---|---|

| Financial Literacy | Guides informed choices | Continuous education |

| Risk Assessment | Protects assets | Diversification |

| Long-term Planning | Ensures sustainability | Regular reviews |

| Goal Setting | Provides direction | SMART objectives |

Read more: Prompt Courier Services for Fast and Secure Deliveries

Conclusion

In conclusion, Alan Waxman Net Worth exemplifies exceptional expertise in investment strategy, showcasing a steadfast commitment to ethical practices and financial literacy. His diverse portfolio, marked by strategic selections, serves as a beacon for budding investors. Through meticulous management and market insight, Waxman fosters a foundation of financial fortitude, guiding individuals toward informed decisions. This profound impact on the investment community emphasizes the importance of diligent decision-making and visionary ventures, ultimately paving pathways to prosperity and prudent wealth management.